- Corporate Governance System

- Committees

- Standards for Selection of Directors

- Standards for Selection of Auditors

- Diversity of the Board of Directors

- Compensation and Incentives for Directors

- Training for Directors and Auditors

- Major Discussion Topics and Themes

- Effectiveness Evaluation of the Board of Directors

- Succession Plan (plan to foster successors)

Based on the Company mission, “Establish a better society through our corporate activities,” the Sanyo Chemical Group will realize sustainable growth toward the future by enhancing both economic and social values in close cooperation with all stakeholders. To this end, we consider the establishment of corporate governance that is trusted by stakeholders to be one of the highest priority management issues.

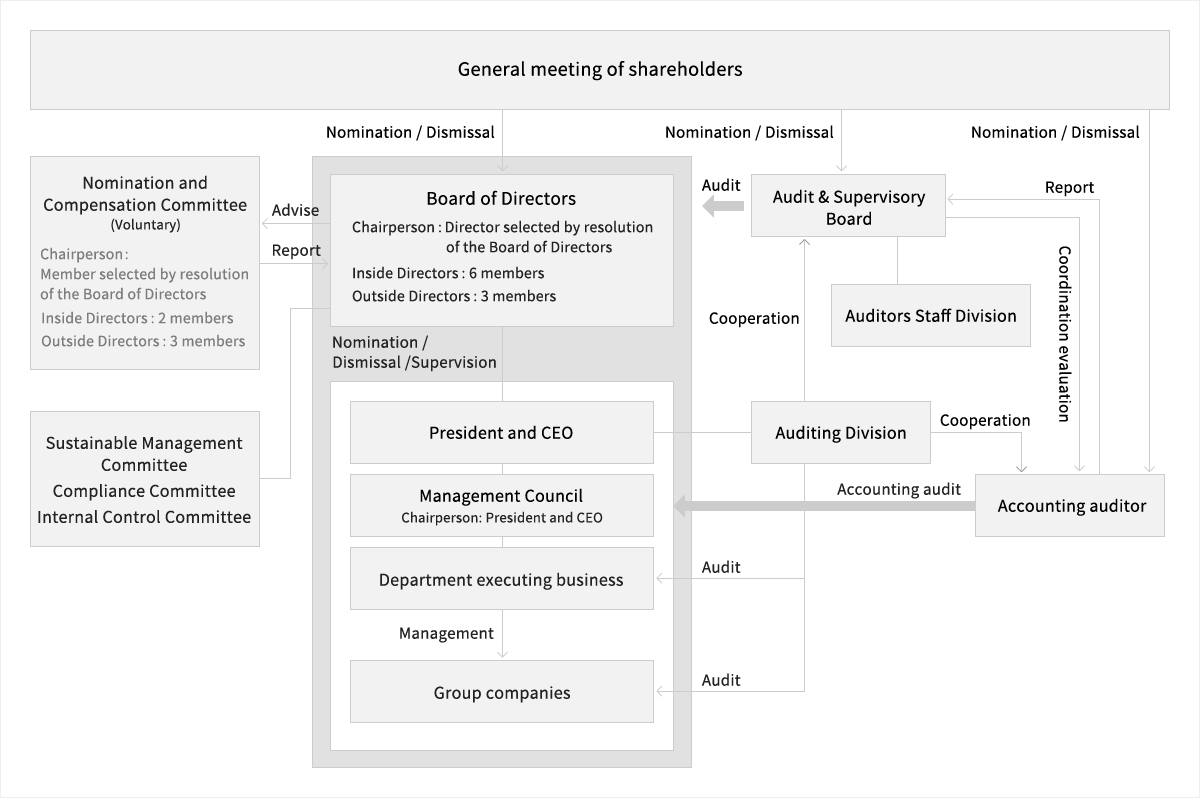

Corporate Governance System

We are a company with an Board of Auditors. The Company has also introduced the executive officer system, under which Executive Officers execute business in accordance with the management policy, etc., determined at meetings of the Board of Directors. In this manner, the Company clearly separates the management decision-making and supervisory function from the business execution function.

Corporate Governance Report (In Japanese Only)

Corporate Governance Structure

*Horizontally scrollable

Directors and the Board of Directors

The term of office of Directors is one year. With the objective of strengthening the management supervisory functions, three out of eight Company’s Directors are independent Outside Directors; moreover, the Chairperson of the Board is appointed from among Directors who are not involved in the execution of business. The Board of Directors holds a meeting, in principle, once a month. It makes decisions on important matters, such as management policy, and supervises the status of business execution by Directors and Executive Officers. In FY2023, 15 meetings of the Board of Directors were held.

Auditors and the Board of Auditors

Of four Auditors, three are Outside Auditors. Auditors not only attend Board of Directors’ meetings, Management Council meetings, and other important meetings, but also inspect important approval documents. They thus audit the status of Directors’ business execution, capitalizing on the knowledge of inside members who are well versed in the wide range of businesses of the Company, as well as the expertise of outside members with experience relating to financial and accounting affairs or with business management experience. In addition, as an organization under the direct control of the Board of Auditors, the Company has established the Auditors Staff Division. The Division staff who assist the Auditors in their duties are independent of the Directors. By establishing this structure, we strive to secure the effectiveness of audits.

Management Council

The Management Council meets once a month, in principle, to make decisions on important matters regarding business execution by Executive Officers, based on the management policy, etc., determined at meetings of the Board of Directors.

Committees

*Horizontally scrollable

| Chairperson | FY2023 Frequency of meetings (times) |

Role | |

|---|---|---|---|

| Nomination and Compensation Committee | Outside Directors |

6 | As an advisory body to the Board of Directors, the Committee, the majority of whose members are outside directors, reports to the Board of Directors on the nomination and compensation of directors, and considers and makes recommendations on matters related to strengthening the functions of the Board of Directors without consultation from the Board of Directors. |

| Sustainable Management Committee | President | 2 | As a body under the direct control of the Board of Directors, the Committee deliberates and makes decisions on the policy for responding to important matters to be addressed with high priority, regarding the process for sustainable growth, the environment, society, and governance. |

| Compliance Committee | President | 2 | As a body under the direct control of the Board of Directors, the Committee deliberates and makes decisions on basic policies and measures to ensure full compliance with laws and regulations. |

| Internal Control Committee | President | 2 | As a body under the direct control of the Board of Directors, the Committee makes decisions on the entire internal control system, and provides instructions and supervision for the internal control system’s development, operation, evaluation, and improvement activities. |

Composition of each committee

*Horizontally scrollable

| Aya Shirai |

Akinori Higuchi |

Masahiro Harada |

Hiroyuki Susaki |

Yoshiyuki Oku |

Kenichi Nishimura |

Hideaki Obata |

Yumi Sano |

|

|---|---|---|---|---|---|---|---|---|

| Nomination and Compensation Committee | ◎ | 〇 | - | - | 〇 | - | 〇 | 〇 |

| Sustainable Management Committee | - | ◎ | 〇 | 〇 | 〇 | 〇 | - | - |

| Compliance Committee | - | ◎ | 〇 | 〇 | 〇 | 〇 | - | - |

| Internal Control Committee | - | ◎ | 〇 | - | 〇 | 〇 | - | - |

Note: ◎ Chairperson, 〇 Committee members

Standards for Selection of Directors

The Company’s policy is to form a Board of Directors consisting of inside directors who have objective judgement, foresight, and insight,etc. into management issues based on the expertise, knowledge, and experience they have accumulated in sales or research, or production or general affairs departments, and Outside Directors who can proactively provide advice and suggestions, etc. based on their rich experience from an objective perspective. In line with this policy, the Company selects candidates while taking into account the balance and diversity, etc. of the Board of Directors, and other elements.

Reason for Selection as Outside Director

*Horizontally scrollable

| Name | Independent Director | Reason for selection |

|---|---|---|

| Aya Shirai | ○ | We have designated Ms. Aya Shirai as an independent director since she meets the Company’s independence standards and is therefore deemed to have no conflict of interest with our general shareholders. She has a wealth of experience gained through administrative activities from her many years of involvement in municipal administration. In addition, she has experience and achievements from having been involved in corporate management as an outside director of other listed companies. She was selected as an outside director because she is expected to contribute to the continuous enhancement of our corporate value by offering useful findings and opinions from an independent standpoint based on her extensive experience and knowledge. |

| Hideaki Obata | ○ | We have designated Mr. Hideaki Obata as an independent director since he meets the Company’s independence standards and is therefore deemed to have no conflict of interest with our general shareholders. In addition to extensive practical experience in administrative departments mainly in HR and general affairs, he has many years of experience and a track record in management of companies with broad business domains. He was selected as an outside director because he is expected to contribute to the continuous enhancement of our corporate value by offering useful findings and opinions from an independent standpoint based on his extensive knowledge and experience. |

| Yumi Sano | ○ | We have designated Ms. Yumi Sano as an independent director since she meets the Company’s independence standards and is therefore deemed to have no conflict of interest with our general shareholders. She has a wealth of practical experience in promoting diversity and developing human resources in a listed company and a public interest corporation. In addition, she has experience and achievements from having been involved in corporate management as an outside director of another listed company. She was selected as an outside director because she is expected to contribute to the continuous enhancement of our corporate value by offering useful findings and opinions from an independent standpoint based on her extensive experience and knowledge. |

Standards for Selection of Auditors

The Company’s policy is to form a Board of Auiditors consisting of outside members who have legal independence in addition to high levels of expertise and discernment based on their experience in serving as a manager or person in charge of accounting in a listed company, and inside members who can express their opinions regarding objective auditing based on their knowledge and experience in specialized fields and who are sufficiently qualified to ensure their independence from those involved in business execution. In line with this policy, the Company selects candidates for the Board of Auditors with its agreement.

Diversity of the Board of Directors

The Company selects candidates for its Board of Directors by comprehensively considering each member’s personality and other aptitudes, in order to form a Board of Directors with a good overall balance of knowledge, experience, and ability to effectively perform its roles and responsibilities. It should also ensure it maintains an appropriate size and diversity, including in terms of gender, internationality, professional experience, and age. To enhance our corporate value in the medium to long term in keeping with the basic philosophy described below, the Nomination and Compensation Committee held discussions on the skill items required for the Company’s Board of Directors, and decided on the following eight items: corporate management; compliance and risk management; understanding of diversity and sustainability; international business; R&D, production, and new business development; sales and marketing; human resource development and training; and finance and accounting. These skill items will be reviewed and revised, if necessary, in the light of the business environment and social circumstances.

Basic philosophy

- Contribute to society through fulfillment of the Company mission: “Establish a better society through our corporate activities”

- Steadfastly maintain a stable management base and proactively develop new businesses while leveraging the strength of our existing businesses

- Realize a WakuWaku company that respects diversity and where all employees enjoy high job satisfaction

As of the end of June 30, 2024, the current Board of Directors consists of eight directors with knowledge in line with these skill items (including three independent Outside Directors, two of whom are female) and four Auditors (two of whom is an independent Outside Auditors). Independent Outside Directors include members who have management experience at other companies.

How to address board diversity

In 2022, The Company identified its material issues. To address one of these issues, “Challenge-oriented and transparent management,” it has set out the following indicators for board diversity.

- Raise the female ratio to 30% or more

- Ratio of independent outside directors: 1/3 or more of the Board of Directors

Skills Matrix

*Horizontally scrollable

| Name | Position | Outside | Independent | Skills | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management | Compliance and risk management | Understanding of diversity and sustainability | International business | R&D, production, and new business development | Sales and marketing | Human resource development and training | Finance and accounting | ||||

| Aya Shirai | Director | ● | ● | ● | ● | ● | - | - | - | ● | - |

| Akinori Higuchi | Representative Director, President and CEO |

- | - | ● | ● | ● | ● | ● | ● | ● | - |

| Masahiro Harada |

Director | - | - | - | ● | ● | - | ● | ● | - | - |

| Hiroyuki Susaki | Director | - | - | - | ● | ● | ● | - | ● | - | - |

| Yoshiyuki Oku | Director | - | - | - | ● | ● | ● | - | - | ● | ● |

| Kenichi Nishimura | Director | - | - | - | ● | ● | ● | - | - | - | ● |

| Hideaki Obata | Director | ● | ● | ● | ● | ● | ● | ● | - | ● | - |

| Yumi Sano | Director | ● | ● | - | ● | ● | - | - | - | ● | - |

| Hirokazu Kurome | Auditor | ● | ● | ● | ● | ● | ● | ● | - | - | - |

| Sho Takeuchi | Auditor | - | - | - | ● | ● | ● | - | ● | - | - |

| Jun Karube | Auditor | ● | - | ● | ● | ● | ● | - | ● | - | - |

| Yusuke Nakano | Auditor | ● | ● | ● | ● | ● | - | - | - | - | ● |

Compensation and Incentives for Directors

Basic policies on compensation for directors

- Secure excellent human resources to improve corporate performance

- Design a compensation level and system that are commensurate with job responsibilities

Process for determining the compensation level and system

The compensation level and system are based on business performance trends and external objective data, and their appropriateness is verified by the Nomination and Compensation Committee, the majority of whose members are outside directors. The basic policy for determining compensation for directors is deliberated and determined by the Board of Directors.

Overview of types of compensation, etc.

The compensation for Directors consists of basic compensation, bonuses, and stock-based compensation.

*Horizontally scrollable

| Compensation type | Overview |

|---|---|

| Basic compensation | The basic compensation is based on the roles and responsibilities of each Director, and is determined by taking into account the status of financial results over the medium to long term and for the relevant fiscal year, as well as levels at other companies. It is paid on a monthly basis. |

| Bonuses | To raise awareness of improving business performance, base pay levels are calculated based on the financial results of the relevant fiscal year, with consolidated ordinary profit used as an indicator of the company’s profitability. Allocation to each director is then determined based on their roles and responsibilities as well as their evaluation. |

| Stock-based compensation | Points are granted depending on the position, etc. based on the Share Delivery Regulations. In principle, the shares of the Company are delivered depending on the number of points when Directors retire. |

Although the ratio of basic compensation, bonuses, and stock-based compensation to the total compensation for each director has not been determined, the compensation level and system are regularly verified by the Nomination and Compensation Committee, the majority of whose members are outside directors, so that they can function as incentives to improve business performance.

Training for Directors and Auditors

For inside and full-time Directors and Auditors, we explain our Articles of Incorporation, Board of Directors Regulations, and other internal rules at the time of their inauguration. For outside directors and full-time outside auditors, we facilitate their understanding of our businesses by conducting tours of our factories and other business sites. In FY2023, we invited an external lecturer to give a lecture on management that takes into account capital costs and stock prices.

Major Discussion Topics and Themes

Board of Directors

- Formulation and revision of the Medium-Term Management Plan and the Comprehensive Plan

- Policy on operating major businesses

- Matters regarding investment, financing

- Confirmation of the results of the effectiveness evaluation of the Board of Directors

- Matters on which to seek advice from the Nomination and Compensation Committee

- Approval of closed financial statements

- Matters regarding procedures for the general meeting of shareholders

- Resolutions on conflict-of-interest transactions, directors’ liability insurance, etc., appointment and dismissal of important employees, and matters related to compensation for directors based on the Companies Act

Nomination and Compensation Committee

- Evaluation indicators reflected in officer compensation

- Verification of a development plan for the next Representative Director, President and CEO candidate

- Management responsibility for extraordinary loss recorded following the withdrawal from the superabsorbent polymer business

- Terms of office of consultants, advisors, and special commissioned employees

Sustainable Management Committee

- Basic Policy on Sustainability

- Response to TCFD Recommendations

- Human Capital Management Activities

- Realization of management that takes into account capital costs and stock prices

- CSR Promotion Management Committee activities

- Sustainable Distribution

Compliance Committee

- Implementation plan and status of corporate ethics study meetings

- Results of the use of whistleblowing contact points for consultation or reporting

- Revision of the Compliance Committee Regulations

- Risk management activities

Internal Control Committee

- Results of the evaluation of internal control activities related to financial reports

- Regarding proposals for disclosing the operational status of the Internal Control System in the Business Report

- Results of the evaluation of the operational status of the Internal Control System regarding significant risks other than those included in financial reports

Effectiveness Evaluation of the Board of Directors

The Company evaluates the effectiveness of the Board of Directors once a year. In FY2023, it conducted an anonymous questionnaire survey of all directors, including outside directors, and all auditors, and evaluated the effectiveness of the Board of Directors based on the results.

FY2023 questionnaire survey on the Board of Directors

Target: All directors including outside directors (nine people) and all auditors (four people)

Timing: March 2024

Method: Conducted anonymously using a third-party system to ensure objectivity

Content: Answer each question in the following major categories on a 5-point scale or in free text

- Composition and operation of the Board of Directors

- Discussions at Board of Directors meetings

- Monitoring function of the Board of Directors

- Performance of Directors

- Support system and training for Directors and Auditors

- Dialogue with shareholders

- Efforts made by each Director

- Operation of the Nomination and Compensation Committee

The results were reported to the Board of Directors’ meeting held in May 2024, and were discussed and analyzed based on the results of a 5-point evaluation and free comments to evaluate the effectiveness of the Board of Directors.

Overview of effectiveness evaluation

The previous year’s evaluation results indicated that there was room for improvement to further enhance the effectiveness of the Board of Directors in the areas of “individual matters related to the operation and discussion of the Board of Directors” and “enhancing support from the Secretariat.” In this survey, there were no responses that gave the low rating of “no improvement,” and almost all respondents rated things as “generally improved.” Based on this, the Board of Directors was evaluated as having made some improvements. Through the survey, it was also evaluated that the effectiveness of the Board of Directors was generally ensured.

Future issues

To further enhance the effectiveness of the Board of Directors, it is necessary for the Chairman to encourage each director to be more active in expressing their views, and for inside directors to engage in more open discussion with awareness that they oversee management. It is also required to review feedback from investors and the appropriateness of holding cross-shareholdings, and to further advance efforts to realize “management that takes into account capital costs and stock prices.” Also recognizing the need to further improve the support system provided by the Secretariat, such as by providing a space for exchange of views among outside directors alone and improving training for directors, we will tackle these issues sincerely.

Succession Plan (plan to foster successors)

To realize our Vision 2030, we have established the personnel requirements that should be met by our Representative Director, President and CEO (the ideal image of the President). In light of these personnel requirements, we systematically provide training to equip successor candidates with the necessary qualities and capabilities, and the Nomination and Compensation Committee regularly reviews its progress, ensuring transparency in the selection process.